United States (US) banks had reportedly flagged Malaysia as "high-risk jurisdiction for money laundering and financial crime", prompting the institutions to flag various transaction involving billions of US dollars as suspicious, MalaysiaKini reported.

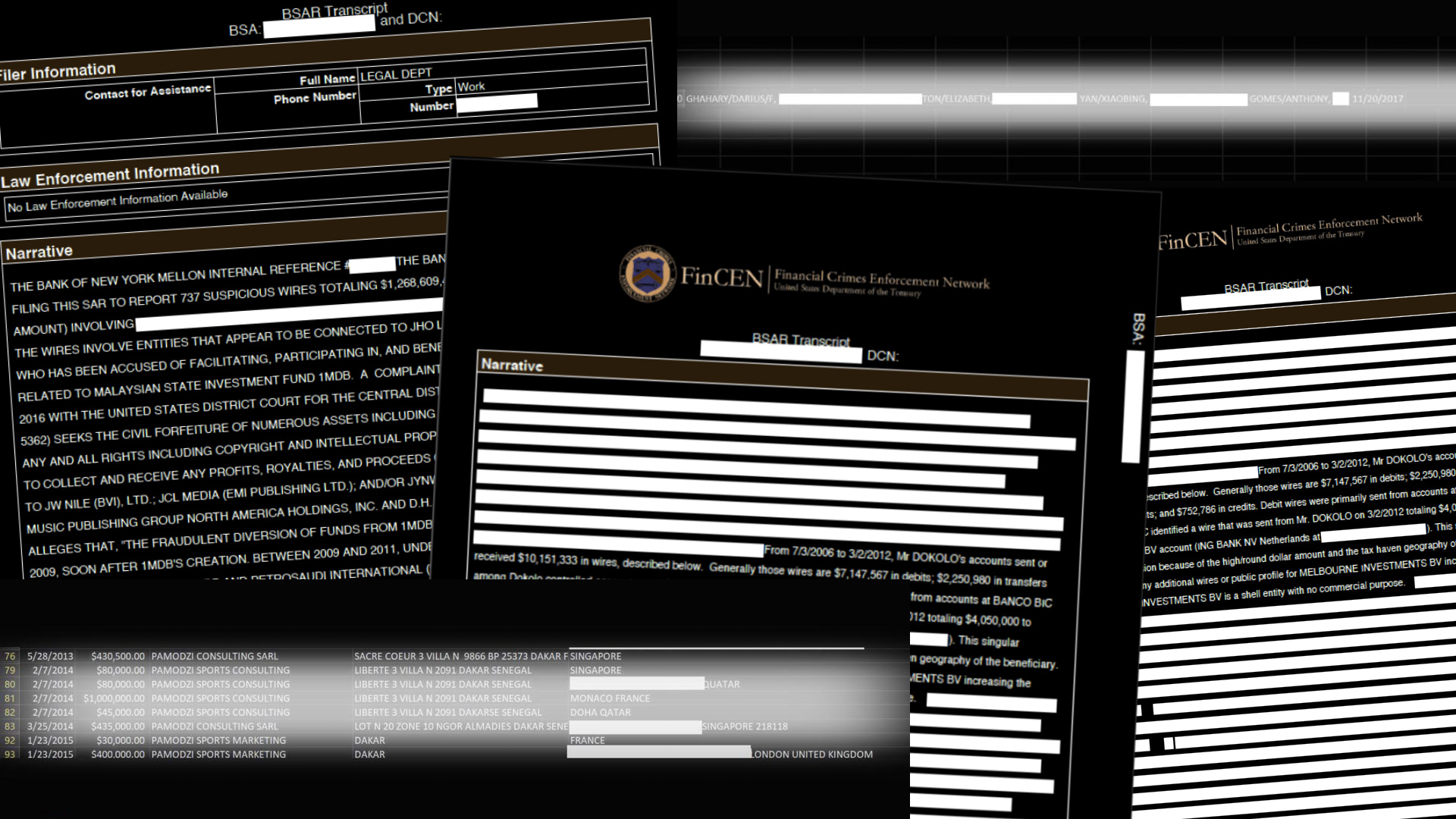

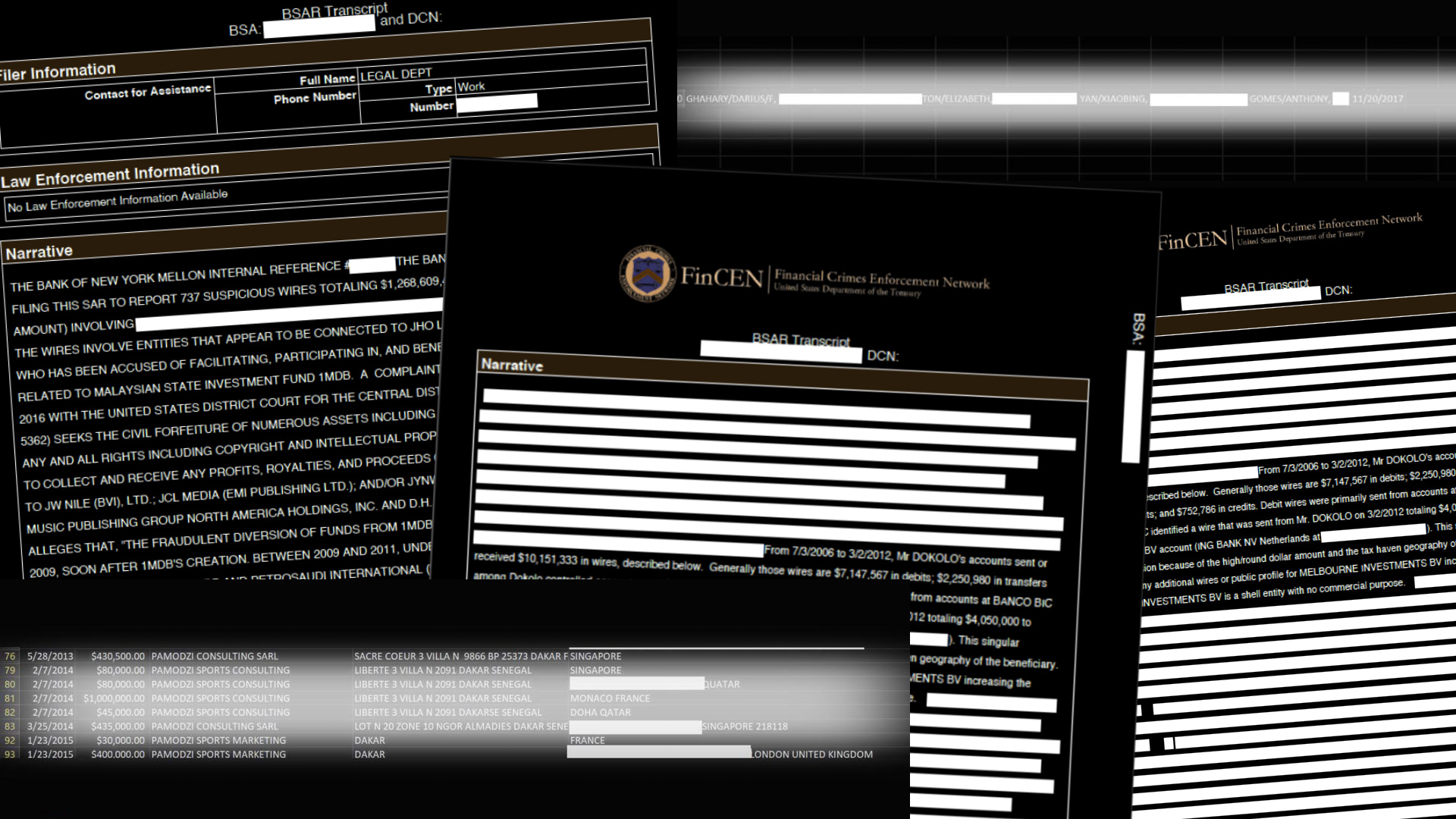

The report was based on an allegedly leaked Treasury’s Financial Crimes Enforcement Network (FinCEN) documents, which was scrutinised by BuzzFeed News and the International Consortium of Investigative Journalists (ICIJ), as well as over 100 news organisations around the world.

Malaysia was among the countries implicated in some of the over 2,100 documents leaked.

According to the reports, nine Malaysian banks, with Public Bank Berhad and AmBank showing the biggest "suspicious" transactions, were involved.

One of the banks that repeatedly flagged the country as "high-risk destination for money laundering and financial crime" was Bank of New York Mellon (BNYM).

In one of its reports, the bank flagged six transactions made via HSBC amounting to US$230,000 (approximately RM950,000) because it could not identify the "true ordering of customer of the wires" and because neither the source of the money nor the reason for transaction could be determined.

There were other transactions involving other parties where the source, the beneficiary or the purposes of transactions were not clear, causing the transactions to be flagged.

Unsurprisingly, the number one (and only) name of a Malaysian involved in this scandal that we could find was that of Low Taek Jho, better known as Jho Low.

We all know of his involvement with the 1MDB scandal and some of the details are mentioned in the documents.

The FinCEN Files showed that BNYM, JPMorgan Chase and other banks had flagged 103 transactions involving Jho Low and 1MDB since 2013 involving USD2.53 billion (RM10.53 billion with current exchange rate).

There were eight Suspicious Activity Reports (SARs) reported between 2009 and 2016.

.png)

SARs is not evidence of criminal activity, but is simply a report made by US banks to the US Treasury of suspicious activities.

In Malaysia, financial institutions are also required to report suspicious activities to Bank Negara Malaysia, which will then investigate the transactions and those involved.

"In January 2017, JPMorgan Chase flagged more than a dozen wire transfers from Low’s companies for the acquisition of a stake in the Park Lane hotel, near Central Park in New York City, and a penthouse downtown.

"The same report identified $30.5 million used to buy paintings by Vincent van Gogh and Claude Monet.

"The real estate and art purchases appeared consistent with transactions mentioned in the Justice Department complaint, the bank report said. In 2016, Swiss authorities seized the artwork," ICIJ's report on Jho Low shows.

Although Malaysia is not the country with the biggest scandal exposed in the FinCEN leak (some banks and countries have terrorist links etc.) but what has been revealed so far is still concerning.

We're not quite sure what the implications of these revelations would be since Jho Low is still on the run and 1MDB scandal is nothing new, but let's hope there will be a banking reform that will prevent more such incidents from happening.

The report was based on an allegedly leaked Treasury’s Financial Crimes Enforcement Network (FinCEN) documents, which was scrutinised by BuzzFeed News and the International Consortium of Investigative Journalists (ICIJ), as well as over 100 news organisations around the world.

Malaysia was among the countries implicated in some of the over 2,100 documents leaked.

According to the reports, nine Malaysian banks, with Public Bank Berhad and AmBank showing the biggest "suspicious" transactions, were involved.

Flagged for several reasons

According to the report by MalaysiaKini, which is one of the news agency attached to ICIJ, there were many reasons Malaysia was flagged.One of the banks that repeatedly flagged the country as "high-risk destination for money laundering and financial crime" was Bank of New York Mellon (BNYM).

In one of its reports, the bank flagged six transactions made via HSBC amounting to US$230,000 (approximately RM950,000) because it could not identify the "true ordering of customer of the wires" and because neither the source of the money nor the reason for transaction could be determined.

There were other transactions involving other parties where the source, the beneficiary or the purposes of transactions were not clear, causing the transactions to be flagged.

Jho Low and 1MDB were involved in some of the biggest flagged transactions

Unsurprisingly, the number one (and only) name of a Malaysian involved in this scandal that we could find was that of Low Taek Jho, better known as Jho Low.

We all know of his involvement with the 1MDB scandal and some of the details are mentioned in the documents.

The FinCEN Files showed that BNYM, JPMorgan Chase and other banks had flagged 103 transactions involving Jho Low and 1MDB since 2013 involving USD2.53 billion (RM10.53 billion with current exchange rate).

There were eight Suspicious Activity Reports (SARs) reported between 2009 and 2016.

.png)

SARs is not evidence of criminal activity, but is simply a report made by US banks to the US Treasury of suspicious activities.

In Malaysia, financial institutions are also required to report suspicious activities to Bank Negara Malaysia, which will then investigate the transactions and those involved.

"In January 2017, JPMorgan Chase flagged more than a dozen wire transfers from Low’s companies for the acquisition of a stake in the Park Lane hotel, near Central Park in New York City, and a penthouse downtown.

"The same report identified $30.5 million used to buy paintings by Vincent van Gogh and Claude Monet.

"The real estate and art purchases appeared consistent with transactions mentioned in the Justice Department complaint, the bank report said. In 2016, Swiss authorities seized the artwork," ICIJ's report on Jho Low shows.

The leak shows widespread issues involving several countries

Although Malaysia is not the country with the biggest scandal exposed in the FinCEN leak (some banks and countries have terrorist links etc.) but what has been revealed so far is still concerning.

We're not quite sure what the implications of these revelations would be since Jho Low is still on the run and 1MDB scandal is nothing new, but let's hope there will be a banking reform that will prevent more such incidents from happening.