A major part of adulting is preparing for the future. You know what they say about always being prepared for a rainy day?

One of the best ways to do this is to get yourself insured. But there are so many types of insurance out there, so how do you choose which is the best for you?

For starters, you should get a protection plan that will cover the medical needs of yourself and your family.

Next, you should think about financial security in case something were to happen that will require you to be away from work for an extended period of time or may result in unexpected expenses.

Let us explain.

Medical Insurance

Having medical coverage, beyond what your workplace/employer provides, is important in case you get sick and the cost is beyond what your company covers, or you lose your job for some reason.

The thing about medical insurance is that it is a great help when it comes to paying off the cost of treatment and hospitalisation, as the purpose of medical insurance is just that: it pays for the cost of treatment and medication in the event you get hospitalised.

However, in the event that you are struck by a critical illness such as a heart attack, stroke or cancer (touch wood!), you may need to take time off work to focus on treatment and recovery thereby affecting your income; you will need a lump sum amount to tide you over till you get better.

This is where critical illness insurance comes in.

Critical Illness Insurance

Like its name suggests, critical illness insurance provides financial aid in the form of a lump sum payout in the event you are diagnosed with a critical illness.

And due to our lifestyle and our diet, critical illnesses such as heart disease, stroke, cancer and others can affect anyone, even seemingly young and healthy people.

The cost of treatment, on the other hand, is also going up consistently.

For example, the cost of treatment for heart attack can go up to RM42,000, for stroke it can go up to RM50,000, RM55,000 for lung cancer, RM85,000 for colon cancer and RM395,000 for breast cancer.

Yup, that’s a lot of money.

On top of the medical costs, you still have your loans and your lifestyle to maintain, and it could get pretty taxing when you have a family depending on you.

And this is where critical illness insurance is important: it provides you with a lump sum of money to help you pay for your daily expenses, any alternative medicine/treatment you’d like to try or any other expenses/debt you have, so you and your loved ones can concentrate on you getting better.

If you’re looking to get critical illness insurance, PRUMy Critical Care is a great option to look at.

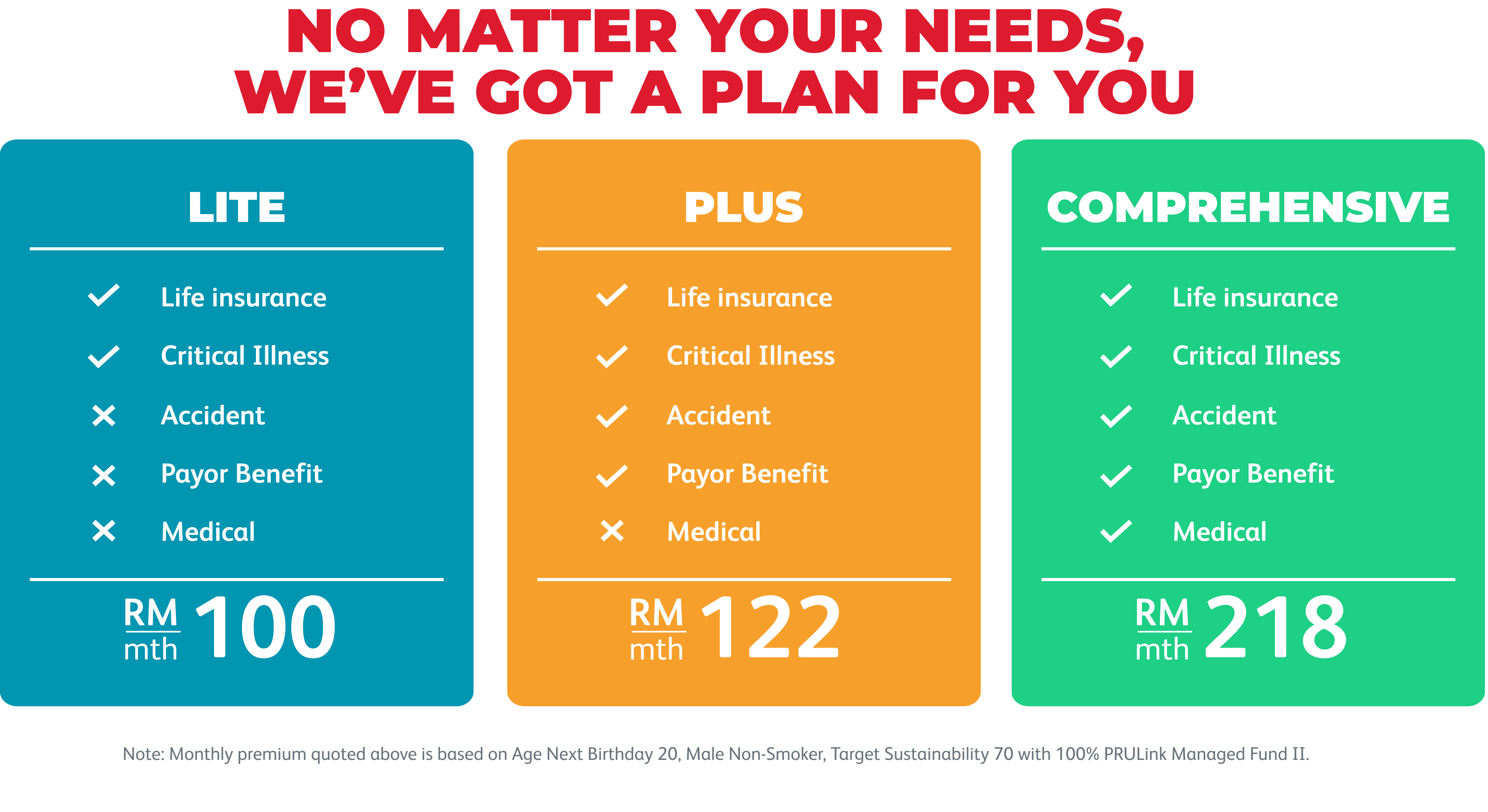

For as low as RM100 a month, you can get protection to help you out financially in case you lose your source of income because of your illness. You wouldn’t have to worry about placing financial burden on your family.

With just a little extra, you can also opt for your coverage to include accidents, payor benefit and medical.

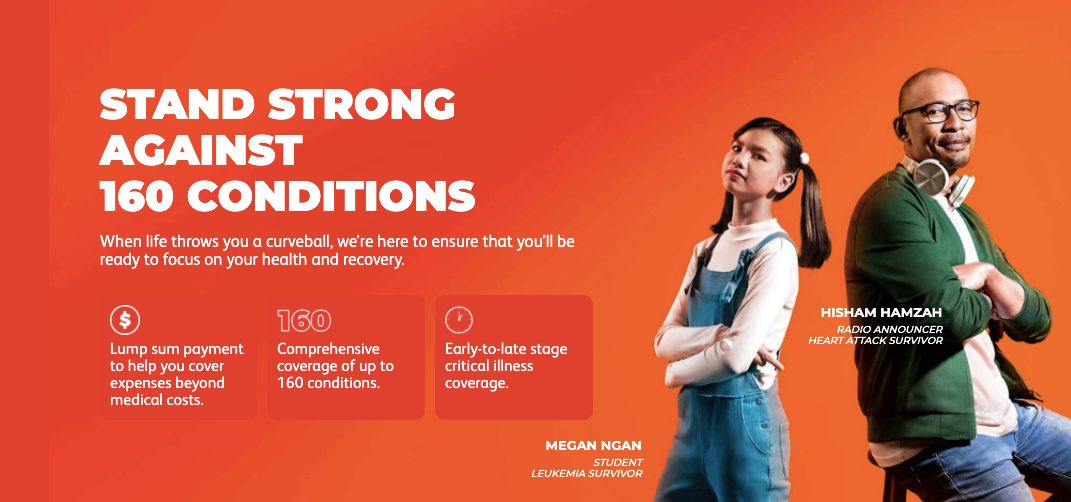

When you’re insured under this policy, you can be rest assured that you will receive comprehensive coverage for up to 160 conditions, no matter at which stage you discover it.

Under PRUMy Critical Care, you can also rest easy knowing that if you are diagnosed with the same type of critical illness (like cancer or stroke) unrelated to the first diagnosis, you would still be covered.

Still not convinced? Hear it from survivors who learnt the importance of having financial protection when they were struck by critical illnesses unexpectedly.

For more information on PRUMY Critical Care, speak to a Prudential Wealth Planner or visit Prudential’s website.

You can also earn free cancer coverage with Prudential

Yeah, we know a lot of people don’t like to talk about the Big C, but Prudential wants you to be prepared.

Now that you know what Prudential can offer with their PRUMY Critical Care plan, they have introduced a challenge that lets you earn free coverage for cancer as a start.

The #StepUpAgainstCancer Challenge allows you to earn up to RM12,500 of free cancer coverage (T&C applies) by literally “stepping up”.

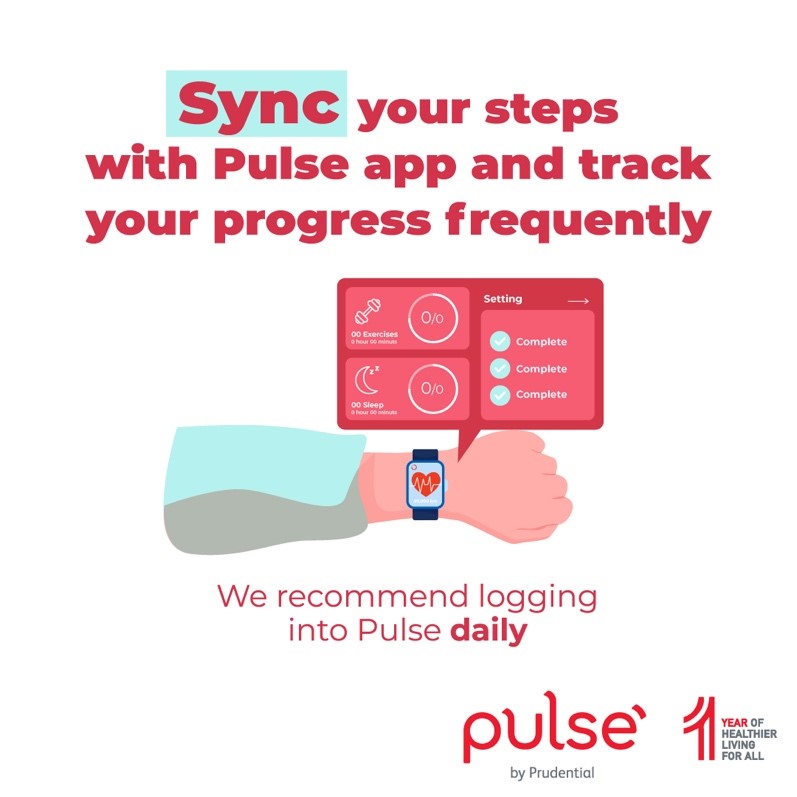

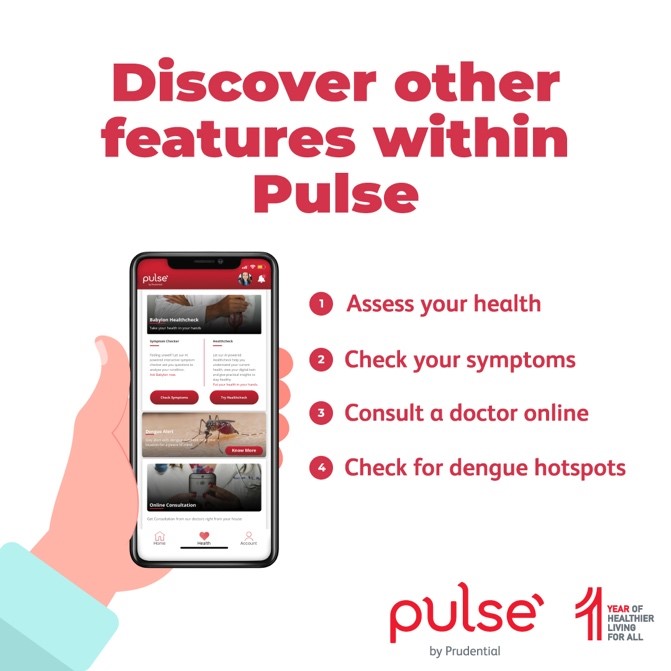

All you have to do is sign up for #StepUpAgainstCancer Challenge on Pulse by Prudential app, and get started with RM500 basic sum assured.

Walk a minimum of 5,000 steps every day to earn up to RM100 coverage amount as reward daily, up to additional RM10,000 coverage within 100 days starting from the first day of sign up.

Also, by inviting someone who is a new registered Pulse user to be part of this challenge, it will give you additional coverage of RM200 per sign-up, up to additional RM2,000 coverage within the same 100 days period. Download Pulse now to participate in the challenge.

#StepUpAgainstCancer Challenge is open to non-Prudential customers who are Malaysian citizens between the age of 19 and 50 on their next birthday. Don’t forget to connect your fitness device with Pulse app to track your daily steps.

There’s a bonus! Users who sign up for the challenge are also automatically eligible for Prudential’s Special COVID-19 Coverage. The coverage provides a RM1,000 cash relief upon diagnosis and hospitalisation, as well as a RM10,000 death benefit due to COVID-19.

Now that you know what you need to do, download the Pulse app and register for the #StepUpAgainstCancer Challenge. Otherwise, head on over to Step Up Against Cancer website, or visit their Facebook page for more information.