Many young Malaysians are trapped in debt, leaving a lot of them close to bankruptcy.

The main cause of this is financial literacy, which basically means the ability to understand how money works as well as how to make, manage, invest and expend money.

Finance Minister Lim Guan Eng told The Star that many young people here have low financial literacy and this does not look very good.

In fact, the financial literacy rate in Malaysia is reportedly only 36 per cent compared to the 59 per cent in most developed countries. This was based on a 2014 study by S&P Global Literacy Financial.

Between 2013 and 2017, 100,610 Malaysians were declared bankrupt and out of this number, 60 per cent were young adults ranging from 18 to 44 years old!

Some seniors are also currently experiencing financial difficulties, especially pertaining retirement plans.

Now, the Employees Provident Fund (EPF) has estimated that a person needs at least RM240,000 in savings by 55 years old in order to retire without worry.

But that is not the case, realistically.

"Based on the EPF 2017 Report, active contributors aged 54 have average savings of only RM214,000 in their accounts," Lim said.

"What is even more worrying is that two-thirds of contributors aged 54 only have RM50,000 and below in their EPF accounts in 2015."

This amount may very well run out within five years. Hence why it is important for Malaysians to pay attention and make the right decisions in terms of spending and investment.

Besides that, the government has proposed creating a cost of living index to measure expenses and help employers determine the right salary for their employees.

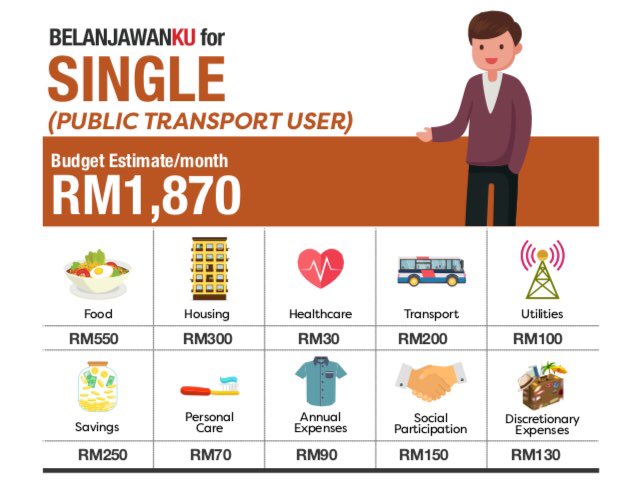

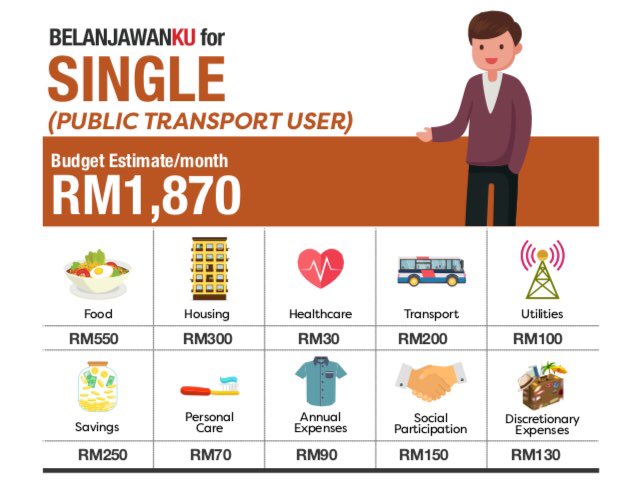

According to New Straits Times, 'Belanjawanku' lays down the minimum measurement of monthly expenses on various goods and services required by households in Klang Valley to live comfortably.

It also acts as a financial guide, taking into account the provision of basic needs, social involvement, recommended savings, social repayment and managing expenses.

Here are some basic guides provided under 'Belanjawanku':

Do you agree and can you relate to this financial guide?

The main cause of this is financial literacy, which basically means the ability to understand how money works as well as how to make, manage, invest and expend money.

Finance Minister Lim Guan Eng told The Star that many young people here have low financial literacy and this does not look very good.

In fact, the financial literacy rate in Malaysia is reportedly only 36 per cent compared to the 59 per cent in most developed countries. This was based on a 2014 study by S&P Global Literacy Financial.

Between 2013 and 2017, 100,610 Malaysians were declared bankrupt and out of this number, 60 per cent were young adults ranging from 18 to 44 years old!

Some seniors are also currently experiencing financial difficulties, especially pertaining retirement plans.

Now, the Employees Provident Fund (EPF) has estimated that a person needs at least RM240,000 in savings by 55 years old in order to retire without worry.

But that is not the case, realistically.

"Based on the EPF 2017 Report, active contributors aged 54 have average savings of only RM214,000 in their accounts," Lim said.

"What is even more worrying is that two-thirds of contributors aged 54 only have RM50,000 and below in their EPF accounts in 2015."

This amount may very well run out within five years. Hence why it is important for Malaysians to pay attention and make the right decisions in terms of spending and investment.

Besides that, the government has proposed creating a cost of living index to measure expenses and help employers determine the right salary for their employees.

According to New Straits Times, 'Belanjawanku' lays down the minimum measurement of monthly expenses on various goods and services required by households in Klang Valley to live comfortably.

It also acts as a financial guide, taking into account the provision of basic needs, social involvement, recommended savings, social repayment and managing expenses.

Here are some basic guides provided under 'Belanjawanku':

Do you agree and can you relate to this financial guide?