Do you find yourself spending money on things you actually don't really need? Or you find yourself slaving away at the end of the month because you ran out of money?

If you do, don't worry; your absolutely not alone.

Taking loans for consumptions

A report by World Bank titled "Making Ends Meet" indicates that 40 per cent of millenials in Malaysia spend beyond their means, exposing them to the risk of bankruptcy.

Citing the 'Finance Matters: Understanding Gen Y' report by the Asian Institute of Finance, the survey reveals that that most Malaysians between the age of 23 and 38 admitted to spending more than they can afford, and many complained of not earning enough to support their lifestyle.

The report says that millenials spent a lot because of “impulse buying behaviour, easy access to personal loans and credit card financing, the want for instant gratification, and seamless online purchasing”.

.gif)

Motor and personal finance loans are said to be one of the biggest cause of bankruptcy among young people in Malaysia, with credit card debt coming close behind.

The report also shows that there is an increase of 104 per cent in bankruptcy caused by default of personal loans, and a 43 per cent increase in credit card defaulters.

In fact, Malaysians seem to take loans for consumption (i.e to to keep up with “lifestyle” choices), rather than for investment, leading to serious financial issues.

.jpg)

Unsurprisingly, we also spend a lot on food. Almost 40 per cent of our income goes towards food and non-alcoholic beverages.

Equal amount is spent eating out and at home.

.jpg)

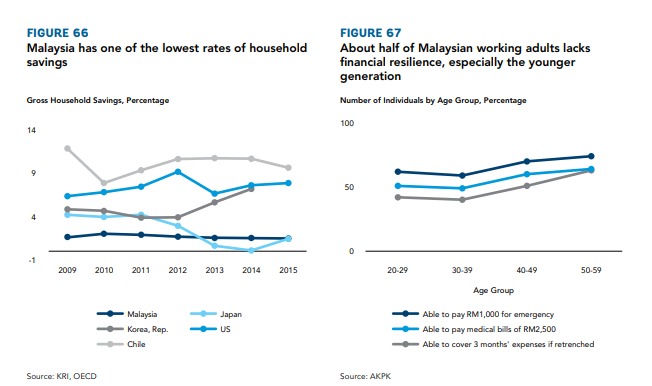

We're not saving enough

While the middle-income group spend more on consumption, the lower income group still struggle to make ends meet.

"The need for dual incomes and holding down multiple jobs per earner was discussed in nearly half of all focus groups conducted in the Klang Valley and Terengganu as part of the joint World Bank-University of Malaya qualitative study on living standards."

"28 percent of the 3,540 randomly-selected Malaysian working adults surveyed in 2018 had to borrow from family and friends to buy essential goods," it further states.

Also, it was found that most Malaysians do not save enough, especially the lower-income group as they barely make enough to sustain their lives.

About half of Malaysian households do not have enough savings for emergency uses, such as medical bills or job loss.

The report shows that financial literacy is still low among Malaysians and needs to be improved.

We found ourselves nodding to a lot of the things mentioned in the report, such as spending a lot on food. How do you think you'd fare?

Perhaps, it's time we collectively take a good, hard look at our finances and figure out ways to make our money work for us.