An investment in knowledge pays the best interest, Benjamin Franklin once said. You don’t have to look further than to those around you to see the truth of those words.

Just ask your grandparents, parents, colleagues or friends whose lives education has changed for the better.

However, not everyone has the privilege of getting the education they deserve due to financial constraints and well, life’s demands.

For years, the National Higher Education Fund Corporation (PTPTN) has enabled thousands of Malaysians to continue with their tertiary education by providing students with the means to pay for their tuition fees and in many cases, enough money for daily expenses as well.

Rojak Daily spoke to a couple of Malaysians who’ve benefited from the education fund and how it had changed their lives, and to a certain extent, the lives of their families as well.

“After the death of my father, I was very worried because being the first born, I thought I will have to work to support my sisters and family.

“I thought that it will be the end of my education and there was not going to be any progress in my life,” Dhyaa recounted.

She was sitting for Sijil Tinggi Pelajaran Malaysia (STPM) examination at that time. Despite dealing with grief and worry about her and her family’s future, she did fairly well.

Dhyaa didn’t entirely give up on her dreams to further her education and she started looking for options.

“That’s when I heard about PTPTN and to be honest, I wasn’t even sure if I’ll be able to get the loan but I put in an application anyway.

“Luckily, they (PTPTN) were wonderful. Knowing that my mother was a single mother, they gave me a 100% loan and some extra to help with my daily expenses,” she said, adding that the stipend went a long way in alleviating her mother’s worries about her welfare.

She also stressed that she had no issues paying back the loan.

“It’s not like I have to pay back RM700 or RM800 a month. PTPTN is the reason I got an education and I hope me, and others, paying back will enable the future generation to benefit as well,” she said.

Dhyaa is now an English lecturer at a private university, and her two sisters also continued their education thanks to PTPTN loans. One of them even managed to turn her loan into a scholarship.

Amber was always a good student, a prefect and actively involved in co-curricular activities in school.

Nobody doubted that she will have a bright future and when she got an admission to study at a local university across the South China Sea, everyone around her agreed that it was what she deserved.

But sadly, all was not well at home. Amber’s parents’ business wasn’t doing very well and they had to relocate in the hopes of cutting cost and reviving it.

“Daily needs were hard enough to meet, let alone a flight ticket to get to the university and other expenses.

“We even spoke about postponing my studies as we just couldn’t afford it,” Amber said.

At that point, she knew about the existence of PTPTN loans, but not that it included a RM1,500 initial loan as long as she had an offer letter.

“It was a relief to me and my family as the money really helped when it came to buying the flight tickets as well as all the other expenses involved in basically relocating and starting a new chapter in my life,” she said.

She added that the stipend that she got also helped keep her tummy full, although she still had to get creative and do some freelance jobs to be able to enjoy her college life beyond just attending classes and completing assignments.

Fast forward 15 years, a career in banking then journalism and eventually as a freelancer, Amber is happy with the way her life had turned out.

“My life would have been very different had I not gotten the loan when I did,” she said.

Many need all the assistance they can and the only way PTPTN can continue to provide the aid is if the current borrowers pay back according to agreed timeline or earlier.

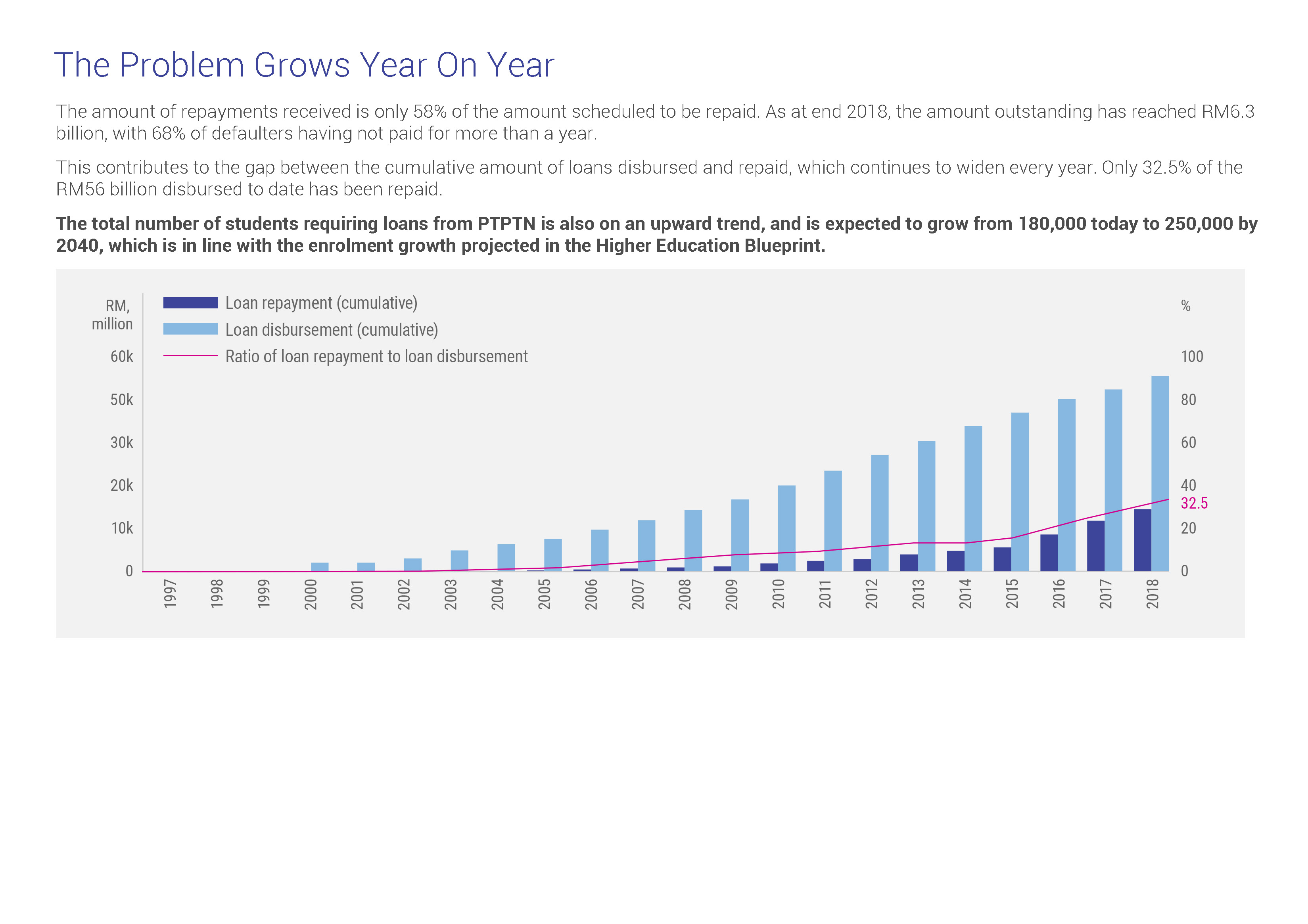

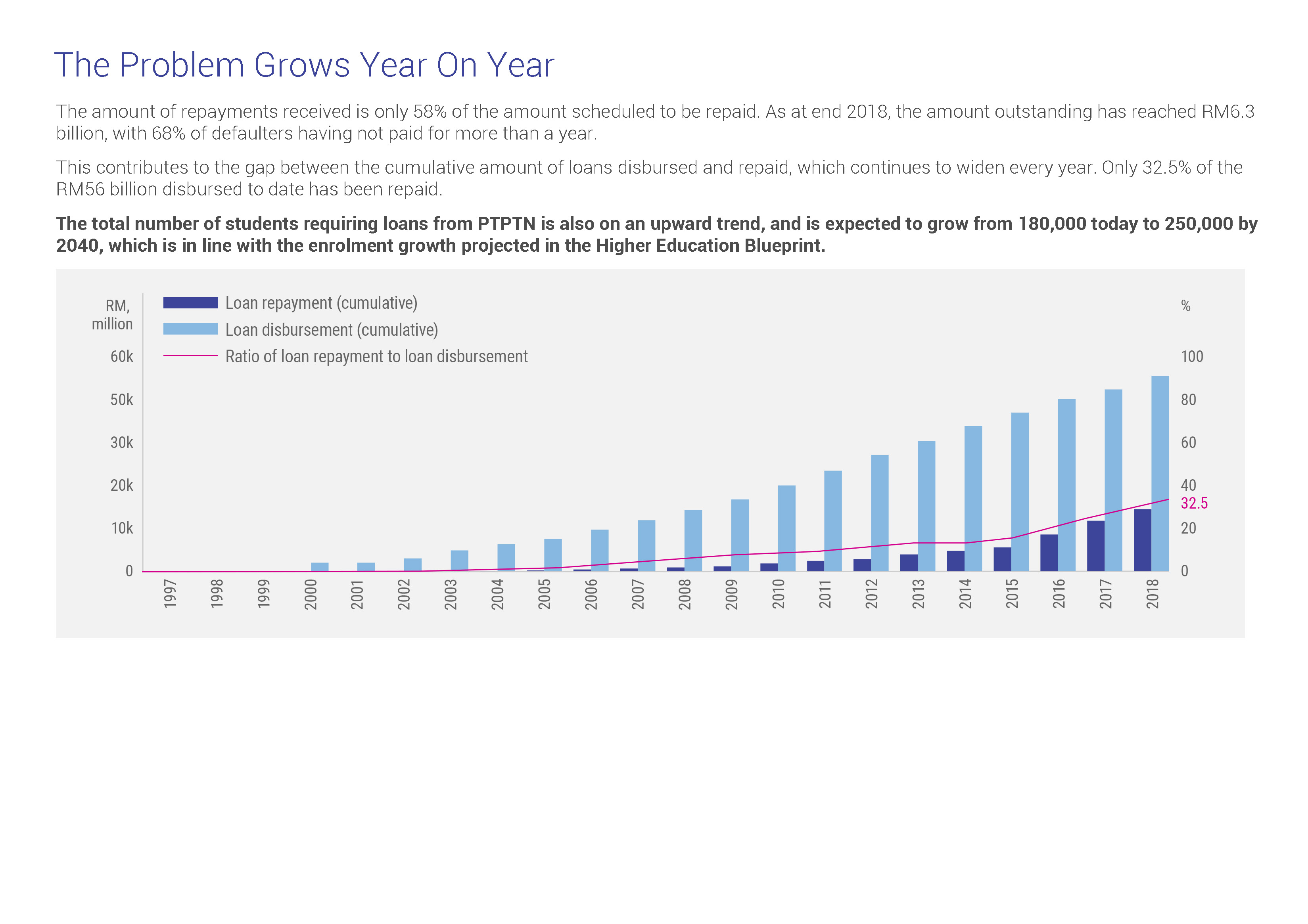

Currently, about 51 per cent of borrowers either don’t pay consistently or at all.

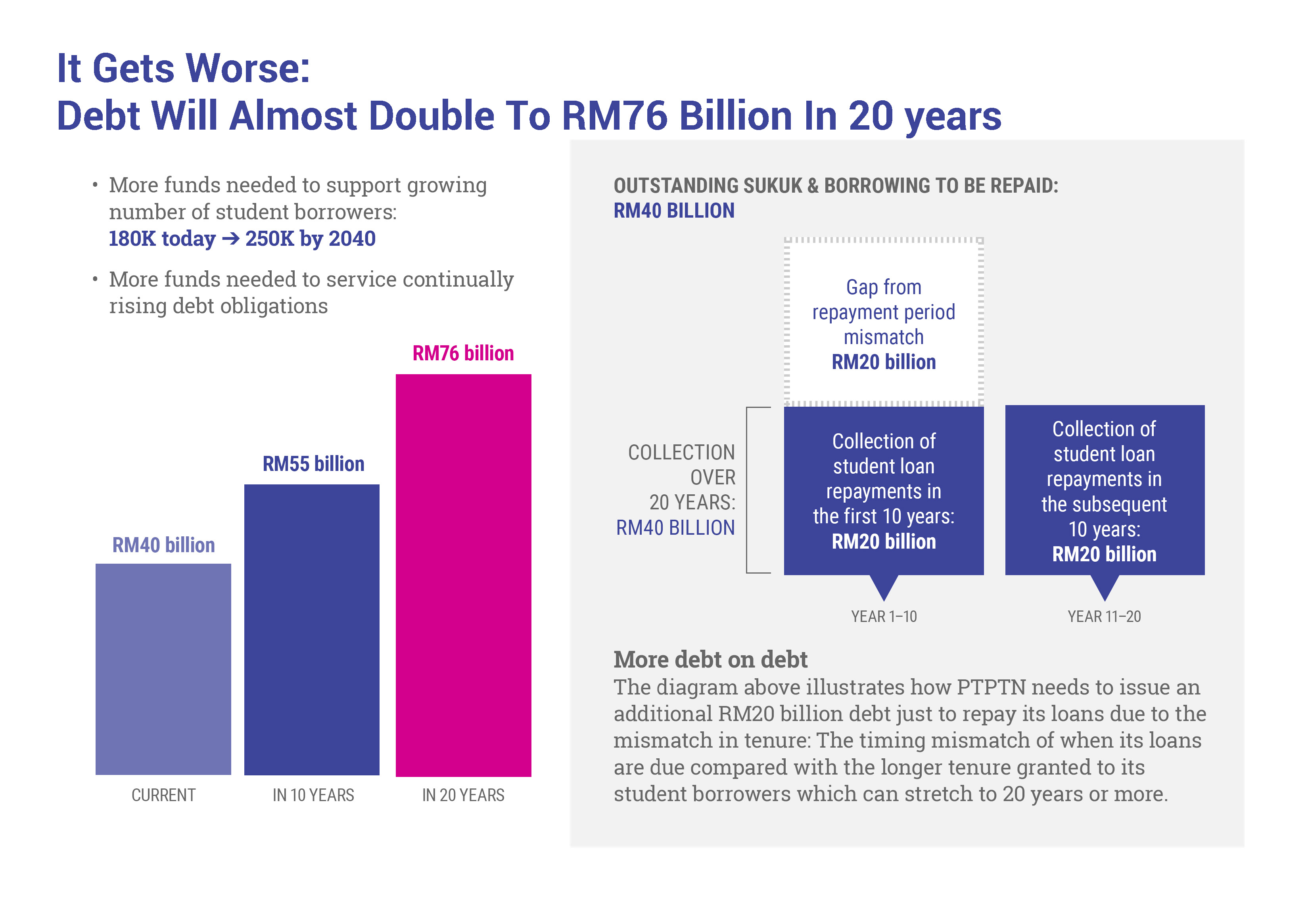

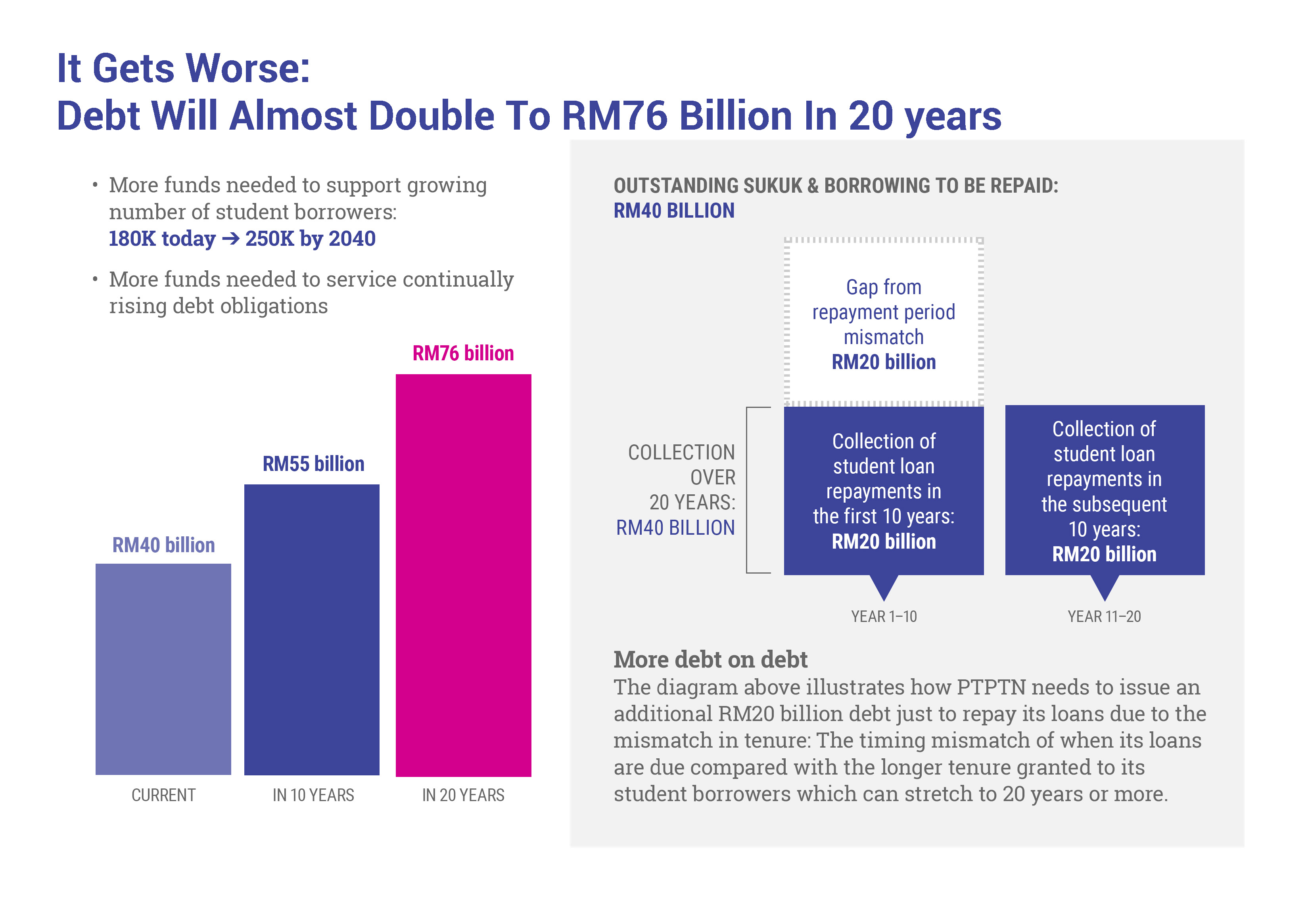

This has forced PTPTN to borrow money from other institutions so that they could continue providing loans to students who need it.

And if the trend continues, the amount owed to outside parties will increase from RM40 billion to RM76 billion within 20 years.

The only way the system can be a sustainable one is if borrowers pay their debt. How this can be done is still a much-debated topic; one that you can be a part of.

PTPTN wants to hear what you have to say about the current repayment method and what the organisation can do to get people to pay their debts.

The People Consultation Paper, launched earlier this year, contains important information on PTPTN and the struggles they’ve been dealing with, 10 PTPTN improvements ideas and a public space for you to provide feedback.

Visit this website to find out more about the issue and contribute your own ideas.

Just ask your grandparents, parents, colleagues or friends whose lives education has changed for the better.

However, not everyone has the privilege of getting the education they deserve due to financial constraints and well, life’s demands.

For years, the National Higher Education Fund Corporation (PTPTN) has enabled thousands of Malaysians to continue with their tertiary education by providing students with the means to pay for their tuition fees and in many cases, enough money for daily expenses as well.

Rojak Daily spoke to a couple of Malaysians who’ve benefited from the education fund and how it had changed their lives, and to a certain extent, the lives of their families as well.

A real life saver

Dhyaa Vinodhan was only 19 when she lost her father, leaving her kindergarten teacher mother responsible for three school-going children.“After the death of my father, I was very worried because being the first born, I thought I will have to work to support my sisters and family.

“I thought that it will be the end of my education and there was not going to be any progress in my life,” Dhyaa recounted.

She was sitting for Sijil Tinggi Pelajaran Malaysia (STPM) examination at that time. Despite dealing with grief and worry about her and her family’s future, she did fairly well.

Dhyaa didn’t entirely give up on her dreams to further her education and she started looking for options.

“That’s when I heard about PTPTN and to be honest, I wasn’t even sure if I’ll be able to get the loan but I put in an application anyway.

“Luckily, they (PTPTN) were wonderful. Knowing that my mother was a single mother, they gave me a 100% loan and some extra to help with my daily expenses,” she said, adding that the stipend went a long way in alleviating her mother’s worries about her welfare.

She also stressed that she had no issues paying back the loan.

“It’s not like I have to pay back RM700 or RM800 a month. PTPTN is the reason I got an education and I hope me, and others, paying back will enable the future generation to benefit as well,” she said.

Dhyaa is now an English lecturer at a private university, and her two sisters also continued their education thanks to PTPTN loans. One of them even managed to turn her loan into a scholarship.

‘My life would’ve been different’

Another success story is that of a freelancer, who only wanted to be known as Amber.Amber was always a good student, a prefect and actively involved in co-curricular activities in school.

Nobody doubted that she will have a bright future and when she got an admission to study at a local university across the South China Sea, everyone around her agreed that it was what she deserved.

But sadly, all was not well at home. Amber’s parents’ business wasn’t doing very well and they had to relocate in the hopes of cutting cost and reviving it.

“Daily needs were hard enough to meet, let alone a flight ticket to get to the university and other expenses.

“We even spoke about postponing my studies as we just couldn’t afford it,” Amber said.

At that point, she knew about the existence of PTPTN loans, but not that it included a RM1,500 initial loan as long as she had an offer letter.

“It was a relief to me and my family as the money really helped when it came to buying the flight tickets as well as all the other expenses involved in basically relocating and starting a new chapter in my life,” she said.

She added that the stipend that she got also helped keep her tummy full, although she still had to get creative and do some freelance jobs to be able to enjoy her college life beyond just attending classes and completing assignments.

Fast forward 15 years, a career in banking then journalism and eventually as a freelancer, Amber is happy with the way her life had turned out.

“My life would have been very different had I not gotten the loan when I did,” she said.

Taken for granted

A lot of us take the privilege of getting an education for granted, but stories like these remind us that not everyone is as lucky.Many need all the assistance they can and the only way PTPTN can continue to provide the aid is if the current borrowers pay back according to agreed timeline or earlier.

Currently, about 51 per cent of borrowers either don’t pay consistently or at all.

This has forced PTPTN to borrow money from other institutions so that they could continue providing loans to students who need it.

And if the trend continues, the amount owed to outside parties will increase from RM40 billion to RM76 billion within 20 years.

The only way the system can be a sustainable one is if borrowers pay their debt. How this can be done is still a much-debated topic; one that you can be a part of.

PTPTN wants to hear what you have to say about the current repayment method and what the organisation can do to get people to pay their debts.

The People Consultation Paper, launched earlier this year, contains important information on PTPTN and the struggles they’ve been dealing with, 10 PTPTN improvements ideas and a public space for you to provide feedback.

Visit this website to find out more about the issue and contribute your own ideas.