As reluctant as most of us are to part with our hard-earned money, at the end of the day, we know that paying taxes is important.

Without taxes, the country will not be able to run; there will be even more potholes on the road, we can say goodbye to the few remaining subsidies that we still get, our healthcare and education will probably be unaffordable for most, and the list just goes on.

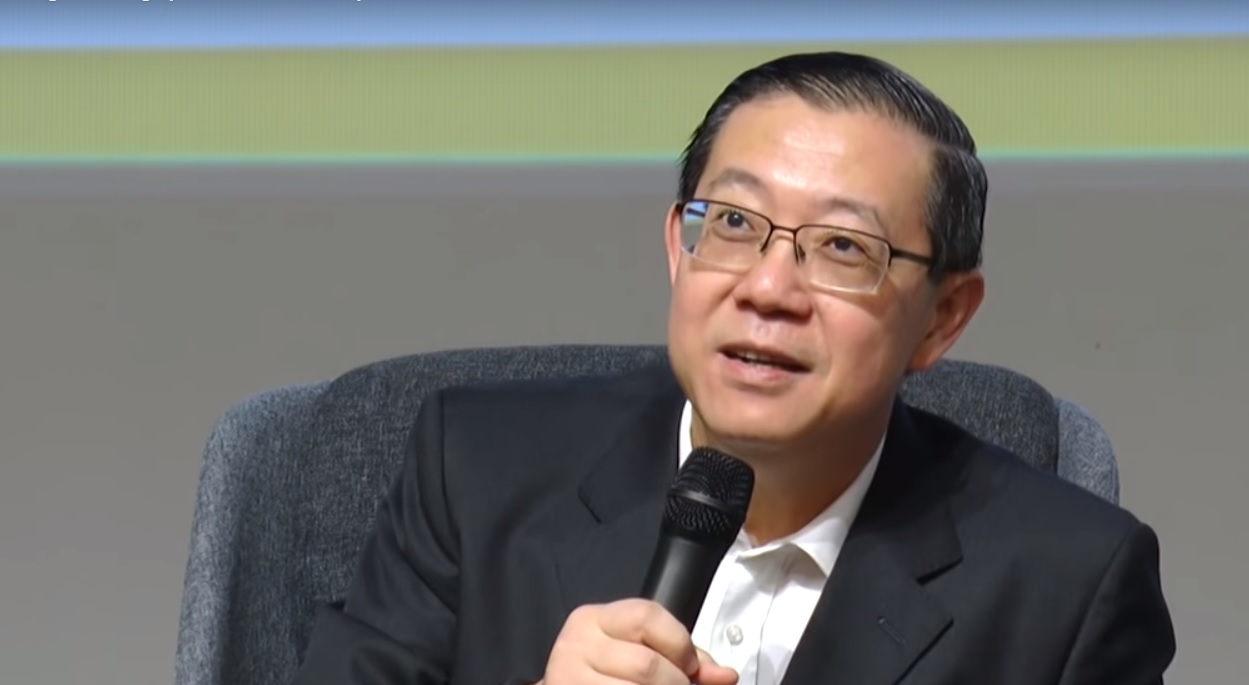

However, in the current economy, we do feel the pinch, so when news of Finance Minister Lim Guan Eng saying that taxes will be increased in tandem with economic growth did make us groan in frustration.

One of the lowest tax collections in the world

.gif)

Will we ever be able to feel comfortable, financially speaking?

Free Malaysia Today quoted the minister as saying that Malaysia has one of the lowest tax collection in the world compared to the size of its economy.

Last year, the Inland Revenue Board (IRB) collected the higest amout of tax at RM145 billion, but apparently that is considered very low when compared to RM1.35 trillion - which was the size of our economy in the same year.

Countries with similar Gross Domestic Product (GDP) as Malaysia recorded higher tax collection. Some of the examples given were Vietnam (19 per cent), Chile (117.4 per cent), Poland (16.4 per cent) and Korea (15.4 per cent), compared to Malaysia's 13.1 per cent.

According to the report, this is not just because the government doesn't tax people enough, but also because a lot of exemptions are given (like when you buy books, for parents' medical bills, childcare etc), low tax compliance and downright tax evasion.

“We do not plan to squeeze everyone dry, (we will decide on raising taxes) based on economic growth. There must be a balance so as not to burden the people too much," Lim reportedly said.

Let's hope he meant it and when whatever new taxes comes into effect, the rich will be the ones most affected (since they can afford it) and not the middle class and especially not the B40.

After all, according to this report released in 2018, the income disparity between the T20 and the rest of the country continues to increase.

Because those who fall under the T20 category start off with a higher base (read: privilege), the income gap continues to grow.

So, if the rich are earning more, it is only logical to tax them more and level the playing field a little bit, no?